FinanceNagpur Latest News

Budget 2020 – The Key Takeaways for People of Nagpur

Finally, the Budget 2020 was unfolded today as our Finance Minister presented through her red file. It carried some interesting takeaways for the common man and people who have been filling Income Tax are now seen with some interesting takeaways. In simple words, the new budget gave many things right from giving the option to reduce the income tax rates to adding new tax slabs and giving not less than 70 different exemptions them.

Some of the key highlights of the Income-tax include the following points:

- Personal income tax – proposed to bring a new income-tax regime for individual Taxpayer’s

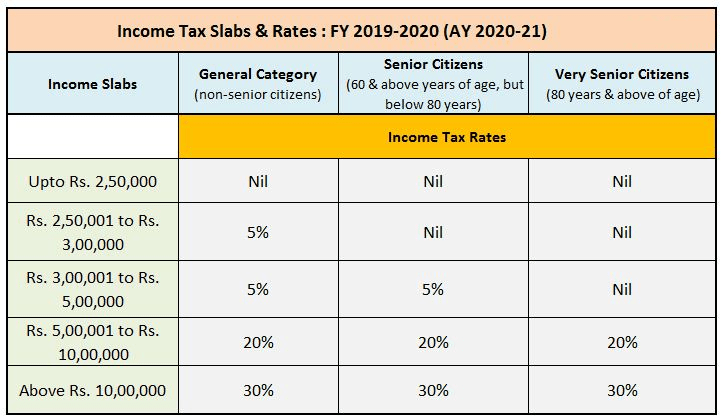

New slab rate (without exemption)

- 10% – income 5 – 7.5 lakhs

- 15% – 7.5 – 10 lakhs

- 20% – 10 – 12.5 lakhs

- 25% – 12.5 – 15 lakhs

- 30% – Above 15 lakhs

- Income upto 5 lakhs no tax, says FM

Income Tax Slab 2020

- If individual ears income of 15 lakhs then the tax would be 1.95 lakh vis-a-vis 2.73 lakhs as earlier the new scheme of individual tax rates is optional

- FM says – reviewed all existing income tax exemptions and removed 70 of them in the new regime and will review remaining and rationalize

- Propose to remove DDT and dividend would be taxable in the hands of shareholders; removal of cascading effect of dividend distributed by holding to subsidiary (25k cr revenues forgone on account of DDT abolishion)

- The concessional tax rate for electricity/power generation companies

- 100% tax exemption on new investment by foreign funds in the infrastructure sector by 2024 with a minimum lock-in period of 3 years.

- ESOPs is given by startups to employees currently taxed as perquisites; differing of tax payment by employees to 5 years.

- Increase in the turnover limit from 25 cr to 100 cr for startups.

- The deduction can be claimed by startups up to 10 years

- Tax audit turnover threshold limit increased from 1 cr to 5 cr

- Concessional 5% withholding tax has been extended to municipal bonds. Cooperatives are taxed at 30 percent now. Cooperatives can choose a 22 percent tax with 10 percent surcharge and 4 percent cess with no exemptions.

- Complete online registration of charitable institutions.

- Faceless appeals on the line of faceless assessment.

- Vivad se Vishwas Scheme introduced – New direct tax dispute settlement scheme.

- More than 4.83 lakhs cases pending at various forums.

- Taxpayer’s need to pay only disputed amount of tax (no penalty be charged) by March 2020; scheme will be available till June 2020 but some additional payment to made in-addition to tax

- CBDT to adopt Taxpayer’s charter.

- PAN shall be instantly allotted on the basis of Aadhar without any filling up of form

- Personal interface with tax administrators will be at minimum level

- GST reforms will continue including a simplified return-filling form. FM says, refund has been simplified and has been fully automated.